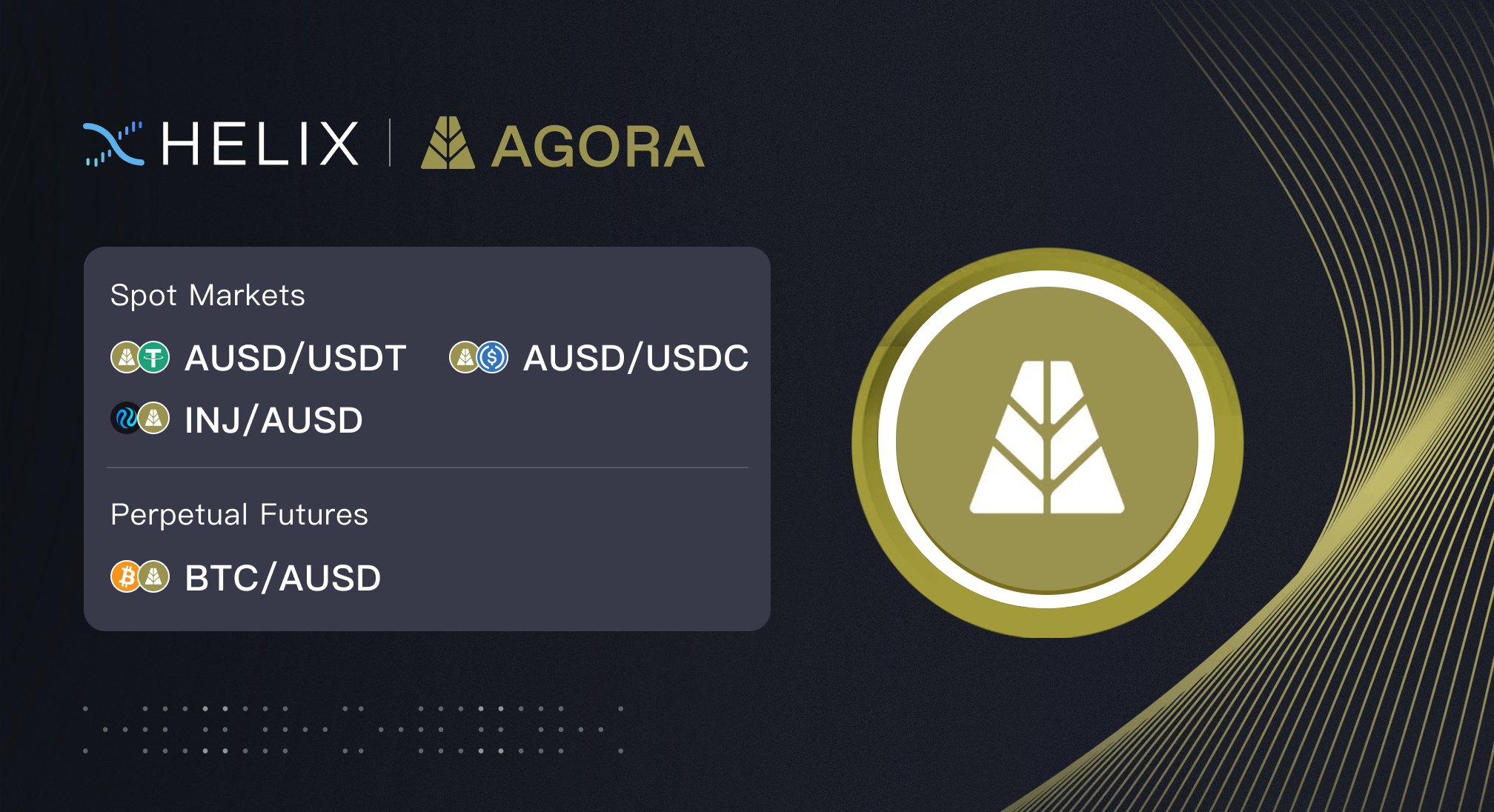

AUSD is now live on Helix! As Injective’s first native stablecoin, it is an exciting development with many markets for AUSD. It not only allows AUSD to be traded on Helix, the premier on-chain derivatives exchange built on Injective, but also allows AUSD to be used as margin for trading derivatives.

Get started here:

- AUSD/USDT: https://helixapp.com/spot/ausd-usdt

- AUSD/USDC: https://helixapp.com/spot/ausd-usdc

- INJ/AUSD: https://helixapp.com/spot/inj-ausd

- BTC/AUSD PERP: https://helixapp.com/futures/btc-ausd-perp

Background on AUSD

AUSD is Agora’s fully collateralized, institutional grade, US digital dollar that is backed by a basket of cash, US treasury bills, and overnight reverse repurchase agreements. The assets backing AUSD are fully managed by the $100B asset management firm, VanEck, and custodied by the $4.1T assets under management (AUM) firm, State Street. Each AUSD token aims to be redeemable for $1 US dollar giving users peace of mind when transacting to avoid volatility compared to other more volatile crypto assets.

AUSD is also differentiated from other stablecoins in how it is institutional-grade, credibly neutral, and aligns its economic model with businesses. This makes it a powerful vehicle in Injective’s initiatives–including burn auctions and on-chain staking–to ensure users are the core beneficiaries of ecosystem revenue.

Since launch, the AUSD stablecoin has grown from zero to a current circulating supply of over $65M with $15M+ in daily volume across ecosystems like Ethereum, Avalanche, Sui, and Mantle. Now that AUSD is expanding to Injective, key ecosystem dApps across DEXs such as Helix, on-ramps, and staking and lending protocols, among others, will be able to adopt the stablecoin into their solutions seamlessly.

Why Trade AUSD on Helix?

With a diverse array of upgrades, Helix 2.0 marks a significant milestone in the evolution of the protocol, introducing a host of cutting-edge features designed to enhance user experience and broaden trading capabilities. Helix provides completely unmatched exchange, trading bots, advanced order types, an intuitive Swap interface, individual profit and loss overview, and reward tracking to Injective users. Anyone can use Helix as a crypto cross-chain trading gateway with zero gas fees, best-in-class security, and lightning-fast speeds.

Market Details

AUSD/USDT Market Details

- Underlying market: AUSD

- Quote asset: USDT

- Minimum price tick size: $0.0001 USDT

- Minimum quantity step: 0.1

- Fee: -0.005% maker fee; 0.05% taker fee

- Trading hours: 24/7/365

AUSD/USDC Market Details

- Underlying market: AUSD

- Quote asset: USDC

- Minimum price tick size: $0.0001 USDC

- Minimum quantity step: 0.1

- Fee: -0.005% maker fee; 0.05% taker fee

- Trading hours: 24/7/365

INJ/AUSD Market Details

- Underlying market: INJ

- Quote asset: AUSD

- Minimum price tick size: $0.01 AUSD

- Minimum quantity step: 0.01

- Fee: -0.005% maker fee; 0.05% taker fee

- Trading hours: 24/7/365

BTC/AUSD PERP Market Details

- Underlying market: BTC

- Quote asset: AUSD

- Minimum price tick size: $1 AUSD

- Minimum quantity step: 0.0001

- Expire: Perpetual (no expiration)

- Maximum leverage: 5X

- Initial margin ratio: 18.18%

- Maintenance margin ratio: 10%

- Fee: -0.01% maker fee; 0.1% taker fee

- Trading hours: 24/7/365

How to Trade AUSD spot markets and BTC/AUSD Perp on Helix?

In order to trade AUSD/USDT, AUSD/USDC or INJ/AUSD spot and BTC/AUSD perp market on Helix, you will need to have USDT or USDC in your Injective Wallet. The first step is to deposit assets to Injective.

Option 1: Bridge USDT or USDC from Ethereum to Injective

- Go to Injective Bridge and connect your wallet;

- Select “Ethereum” from the dropdown menu as the origin source;

- Select “USDT”or “USDC” as the asset to transfer and make sure it has USDT or USDC balance;

- Enter the amount of USDT or USDC tokens you would like to transfer and click “Review Deposit” and “Confirm”;

- Once the transfer is completed, you can check the USDT or USDC balance in your Injective Wallet or Account page on Helix.

Option 2: Onboard with Fiat

- You can also onboard onto Helix using popular fiat currencies by selecting from one of the fiat on-ramp providers such as Mercuryo, Kado, Transak or Payfura.

- Choose your payment currency (e.g. USD) and enter the amount in fiat you would like to swap;

- Select Injective as the network to receive your payment amount;

- Follow the instructions and continue the steps;

- Once the transfer is completed, you can check the USDT balance in your Injective Wallet or the Balances page on Helix;

- Swap INJ to USDT by using the Swap feature if needed, and then you are all set to trade!

Trade AUSD/USDT or AUSD/USDC on Helix

- Go to the AUSD/USDT or AUSD/USDC market on Helix;

- Choose the side you want to trade on, either Buy (Long) or Sell (Short);

- Then choose the type of order you want to trade, from Market, Limit, or more advanced types;

- Enter the amount you want to trade;

- Submit your order and approve it with your wallet;

- Once the order is approved successfully, you will see a notification “Your order has been placed.”

- Note: you can sell USDT or USDC to get AUSD through both markets and utilize the AUSD to trade the INJ/AUSD and BTC/AUSD PERP markets.

Trade INJ/AUSD on Helix

- Go to the INJ/AUSD market on Helix;

- Choose the side you want to trade on, either Buy (Long) or Sell (Short);

- Then choose the type of order you want to trade, from Market, Limit, or more advanced types;

- Enter the amount you want to trade;

- Submit your order and approve it with your wallet;

- Once the order is approved successfully, you will see a notification “Your order has been placed.”

Trade BTC/AUSD PERP on Helix

- Go to BTC/AUSD PERP market on Helix;

- Choose the side you want to trade on, either Buy (Long) or Sell (Short);

- Then choose the type of order you want to trade, from Market, Limit, or more advanced types;

- Enter the amount you want to trade and select your desired leverage;

- Submit your order and approve it with your wallet;

- Once the order is approved successfully, you will see a notification “Your order has been placed.”

Upcoming Listings

Moving forward, Helix will continue to expand the markets available for users. All community members can propose to bring new assets to Helix using the governance portal on the Injective Hub. Ultimately, all INJ token holders own Injective so the community has the power to bring new assets to the dApp ecosystem.

Stay updated on all new listings by joining Helix on Twitter and Telegram!

Useful Resources

- How to create your Injective wallet: Link

- Onboard onto Injective instantly with fiat: Link

- Transfer assets to Injective via Injective Bridge: Link

- A quick guide on how to make a trade on Helix: Link

- Earn trading fee discounts by staking INJ: Link

- Trade on Helix and earn points: Link

This article is for informational purposes only and is not financial advice or an endorsement of a particular project or application. Use of Helix is subject to Helix’s Terms and Conditions.

About Helix

Helix is the premier decentralized crypto exchange. Helix provides access to unlimited crypto assets and perpetual markets with market leading rebates. Best-in-class security, near zero fees, lightning fast speeds, cross-chain capabilities and a fully on-chain orderbook on Helix provide the optimal gateway to bring crypto trading to the masses. Helix is built on Injective, the interoperable layer one blockchain for building powerful exchange, DeFi, derivatives & Web3 applications.

Website | Telegram | Twitter | Blog

About Injective

Injective is a lightning fast interoperable layer one blockchain optimized for building the premier Web3 finance applications. Injective provides developers with powerful plug-and-play modules for creating unmatched dApps. INJ is the native token that powers Injective and its rapidly growing ecosystem. Injective is incubated by Binance and is backed by prominent investors such as Jump Crypto, Pantera and Mark Cuban.

Website | Telegram | Discord | Blog | Twitter | Learn | Youtube | Facebook | LinkedIn | Reddit | Instagram | Orbit Newsletter

About Agora

Agora is a stablecoin startup co-founded by Nick Van Eck, Drake Evans, and Joe McGrady. It offers a stablecoin for users outside of the U.S. and will be pegged to the dollar. The stablecoin, AUSD, is backed by US Treasury bills and overnight repurchase agreements. The firm emphasizes transparency and trust and will be overseen by VanEck, which will manage a fund for Agora’s reserves.